postmates tax form online

I dont know who or if we can report them to. There are two places you can find your Uber 1099 forms.

The Ultimate Guide To Taxes For Postmates Stride Blog

Postmates tax form online Saturday March 19 2022 Edit How To Get Postmates Tax 1099 Forms Youtube Postmates Taxes The Complete Guide Net Pay Advance The Ultimate Guide To Taxes For Postmates Stride Blog Postmates 1099 Tax Filing The Complete Guide Postmates 1099 Taxes The Last Guide You Ll Ever Need.

. Fill Out Your IRS Tax Forms Online Free. This means Postmates drivers are eligible for Postmates 1099 tax write-offs such as self-employment tax deductions. Postmates drivers are self-employed.

Try for FreePay When You File. A 1099 form is an information return that shows how much you were paid from a business or client that was not your employer. It will look something like this.

Try it free with a 7-day free trial cancel anytime. E-File or Print Mail. With Keeper we can automatically categorize your purchases for tax write-offs.

Your 1099 should be there by January 31st. According to Postmates if you dont meet this requirement you wont receive a 1099-NEC. This ensures that your income is taxed properly Tade A.

16 Write-Offs For Postmates Drivers If you deliver foods from restaurants using the app here are the deductions you would need to know about for your Postmate taxes. The most important box on this form that youll need to use is Box 7 Non-employee Compensation. Be sure to download and save a copy of your 1099 for your records.

I feel like for them to be this shitty of a company there has to be something illegal going on right. 6 votes and 9 comments so far on Reddit. Postmates will send you a 1099-NEC form to report income you made working with the company.

Typically you should receive your 1099 form before January 31 2021. It includes information on your income and expenses and youll attach this to the rest of your tax return. Well give you the quick checklist of items you qualify for to lower your taxable income.

There are many IRS 1099 forms but our guide will only review the most relevant ones for your Postmates taxes. Also if your earnings from Postmates deliveries are less than 400 and you do not have any other source of income you do not have to pay taxes at all. Online Tax Forms Included.

In this Video I try my best to explain Postmates taxes. Look for the Tax Information tab. Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment.

From how to pay your postmates taaxes to what write offs you can claim with postmates. With that said Postmates driver self-employment means its important to understand the proper way to account for unique delivery driver tax deductions. Your taxable income from self-employment will be taxed at ordinary income tax rates.

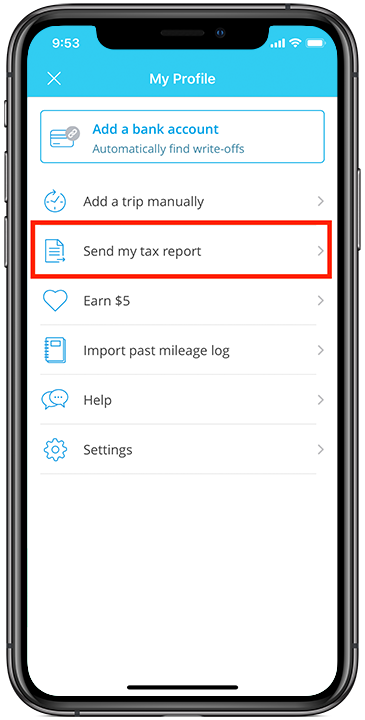

Intuitive Instructions IRS E-File Fast Refunds. Did anyone else just now get their tax forms for Postmates. Get your 1099 form from Postmates.

IRS Tax Forms For A Postmates Independent Contractor As a Postmates delivery driver youll receive a 1099 form. That means youd only pay income tax on 80 of your profits. You will also be assessed a Self-Employment tax Social Security and Medicare that calculated at a roughly 15 tax rate.

You pay 153 SE tax on 9235 of your Net Profit greater than 400. You can also find a copy of your 1099 in your Uber app by going to Account - Tax Info - Tax Forms. While Stride operates separately from Postmates I can tell you that Postmates will only prepare a 1099-MISC for you if.

Fortunately you can still file your taxes without it. I mean Ive got it so I cant exactly report them to the irs to get them to send it to me but its the end of February. By linking your Uber Eats account your Postmates delivery account should migrate with you and be displayed in-app on your Uber Profile app.

How To Get Postmates Tax 1099 Forms Since youre an independent contractor and classified as a sole proprietor you qualify for the Section 199A Qualified Business Income deduction. Ad 0 Federal Filing. Your earnings exceed 600 in a year.

For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits. Enrolled Agent with the IRS Can I file my self-employment income with my W-2 income. TurboTax will do all the calculations for you based upon your Schedule C.

Postmates Tax Deductions Back Story. Regardless of whether or not you receive a 1099-NEC you must still file taxes with the IRS. Printing or electronically filing your return reflects your satisfaction with TurboTax Online at which time you will be required to pay or register for the product.

With Postmates Unlimited you get free delivery with no blitz pricing or small cart feesever. PostmatesUber Tax Form 1099 Help. If you have earned more than 600 in one year through Postmates deliveries the company will send you a 1099 form documenting all your earning.

You will need to use the Online Self Employed version or any Desktop program but the Desktop Home Business version will have the most help. Unlimited free deliveryonly for Unlimited members. Since Postmates has been acquired by Uber youll need to reach out to Uber for your 1099.

According to Postmates if you dont meet this requirement. TurboTax online and mobile pricing is based on your tax situation and varies by product. Postmates will only prepare a 1099-NEC for you if your earnings exceed 600 in a year.

I can no longer go online in my Postmates Fleet app. Youll report your self-employment income on a form called the Schedule C. Postmates has joined Uber Eats which means customers and delivery requests have switched to the Uber app as of June 7 2021.

How To Get Your 1099 Form From Postmates

How To Get Postmates Tax 1099 Forms Youtube

.png)

Postmates 1099 Taxes The Last Guide You Ll Ever Need

The Ultimate Guide To Taxes For Postmates Stride Blog

The Ultimate Guide To Taxes For Postmates Stride Blog

How To Get Your 1099 Form From Postmates

The Ultimate Guide To Taxes For Postmates Stride Blog

The Ultimate Guide To Taxes For Postmates Stride Blog

Postmates Driver Review 2022 Make Money Delivering Stuff

Postmates Driver Review 2022 Make Money Delivering Stuff

Postmates 1099 Taxes The Last Guide You Ll Ever Need

Chipotle Sign Saying Staff Walked Out Goes Viral Plus 22 More Similar Signs From Other Us Businesses Sign Quotes Inspiring Quotes About Life Sayings

Postmates Driver Requirements 2021 Review Background Check

What Are The Biggest Threats To Postmates Business Model September 2016 Quora

Postmates 1099 Taxes The Last Guide You Ll Ever Need

Postmates Driver Review How Much Do Postmates Drivers Make Gobankingrates

Postmates Driver Review 2022 Make Money Delivering Stuff